How to Negotiate Medical Bills: A Simplified Guide + What You Need to Know: If you haven't experienced it yourself, you've most likely witnessed a loved one go through it: You're surprised with a bill that's far higher than you expected weeks after a medical procedure. This can be due to a procedure not being covered by your insurance plan, or it can be owing to your medical provider being out of network. Whatever the reason, being faced with a bill you can't afford is an awful feeling.

Fortunately, there are techniques that may be put in place to reduce the uncertainty surrounding your therapy. This is especially critical for the 28 million Americans who do not have health insurance. Regardless of your health-care coverage, you can gain control by learning how to negotiate medical expenses.

1. Agree on Procedures Ahead of Time

Medical crises are unavoidable, and they can throw medical bill preparation out the window. Planned procedures, on the other hand, offer a unique opportunity to negotiate with health care providers before you enter their office, keeping you out of their clutches. Often, these scheduled checkups eliminate the need for some emergency visits entirely.

It's not a bad idea to shop around for the best deal on a doctor, just like it's not a bad idea to shop around for the best deal on a car. Being forthright is preferable in this scenario. Inform the doctor about the treatment you require as well as the fees charged by other doctors in the region. If they have wiggle room in their price, now is the moment to take advantage of it. Keep in mind, however, that an experienced doctor's proven skill may be worth the comparatively greater cost of their services.

Questions to consider while discussing hospital or medical bills prior to your operation include:

Can I avoid paying any fees if I agree to pay now?

Is it possible to get a financial hardship discount?

What is the most competitive price supplied to insurers?

2. Check Your Itemized Bill for Errors

Yes, medical invoices might contain inaccuracies. In fact, some watchdogs believe that more than 90% of bills contain inaccuracies. As sad as this is to learn, it does provide you the opportunity to reduce your rates even after having emergency treatment. Those who have high insurance deductibles stand to benefit much more.

Before you start fact-checking your bill, make sure you're referring to the correct statement. An Explanation of Benefits will be sent by your insurance company, however this is subject to change while your claim is being processed. Consider deferring payment until you have requested and received your provider's itemised bill.

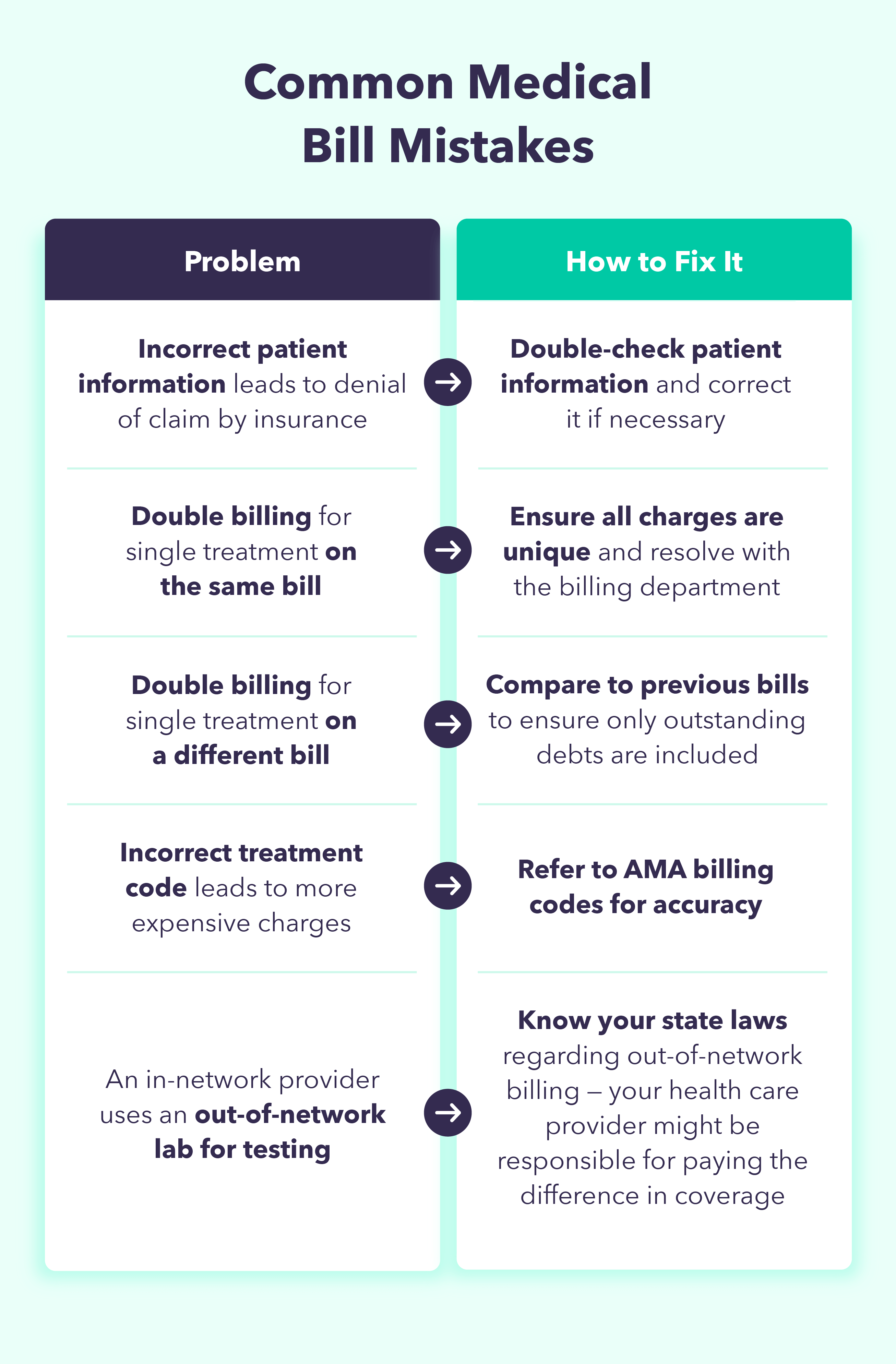

Your itemised bill is the greatest place to look to see whether mistakes are raising the amount owed. The following are examples of common errors seen in medical bills:

Incorrect patient information: This can result in a claim being denied by insurance.

Double billing for a single treatment: It is possible for the same treatment to appear twice on the same bill. In other instances, a previously paid-for treatment emerges afterwards.

Incorrect treatment code: This can result in higher charges. These codes can be validated by visiting the American Medical Association (AMA) website.

An in-network supplier makes the error of sending tests to an out-of-network lab: Many states have safeguards in place to protect patients in this situation, banning them from paying for unnecessary out-of-network tests.

Confirm that you are only paying for what your plan requires by reconciling this itemised bill with your medical and insurance providers. You might as well take full benefit if you're already paying a premium for your insurance policy.

3. Request a Price Reduction

Many people have the misconception that a bill is non-negotiable. That is true for retail purchases – a sales clerk does not have the time or interest in bargaining over the price of a garment. A medical bill, on the other hand, is a different issue.

Insurance companies, too, bargain with medical providers on how much they are ready to pay for their services. This reduced price is also available to you, especially if you are uninsured. The trick is that you must know how to ask for it.

People who do not have insurance can utilise this approach to achieve the same low premium. It can also be used by persons who underwent therapy that was not covered by their current insurance.

Inquire with your billing department about the negotiated rate offered to insurance companies. The charge you received was most likely far higher than this rate because the hospital was already anticipating a reduction from your insurance company.

4. Check if You Qualify for Aid

Medical costs are likely to be among the most expensive personal bills that the average person will face in their lifetime. In 2020, hospital charges in the United States averaged $2,607 per day. That is why so many organisations exist solely to assist others in repaying their debts. Choosing not to pursue one of these avenues is like to leaving money on the table that was purposefully left there for you.

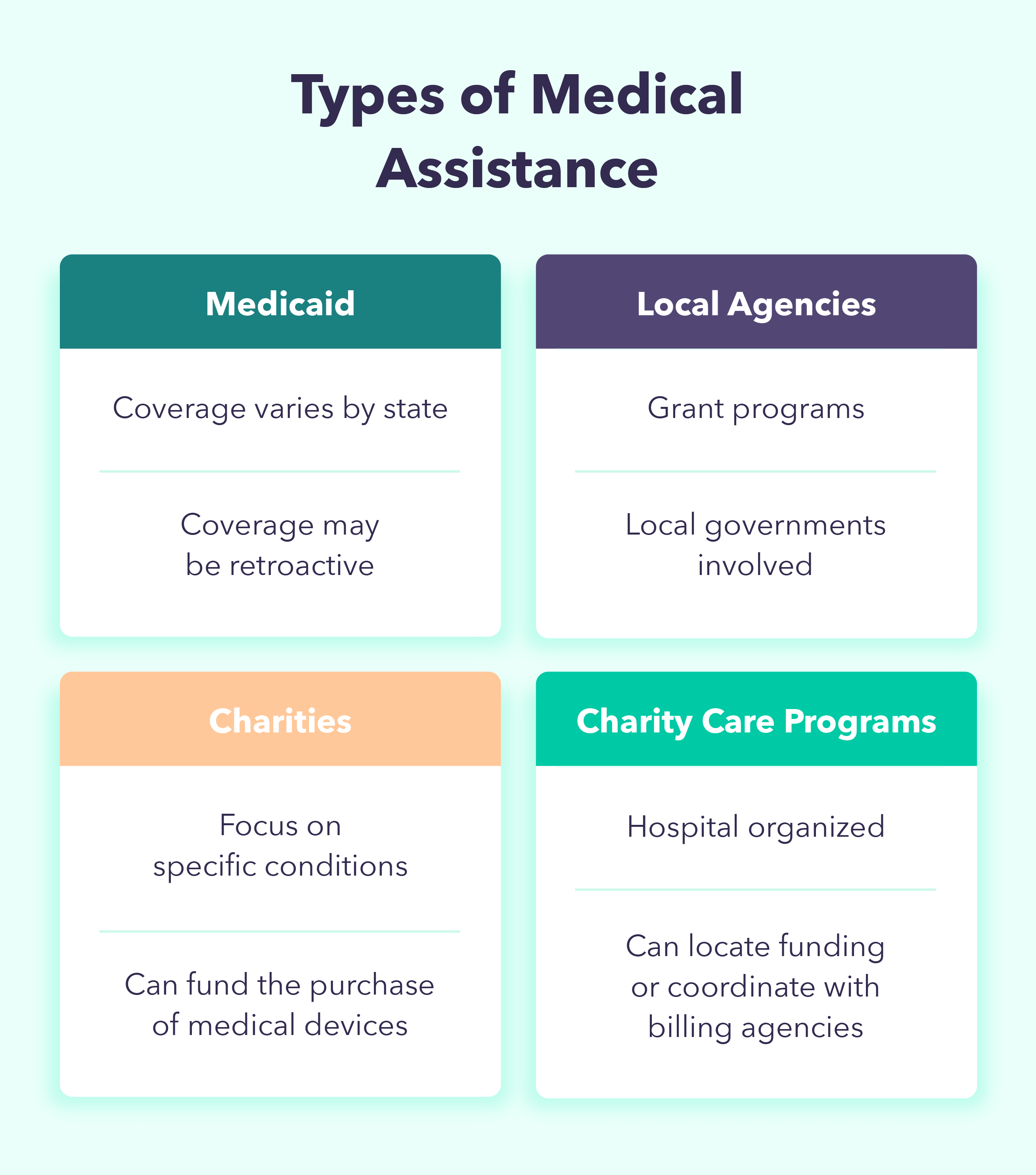

Medicaid

The Medicaid insurance programme was created by the federal government expressly to assist low-income Americans who are struggling with medical expenditures. In most jurisdictions, if you were eligible at the time, this emergency coverage can cover your original charges even if you did not have an ongoing policy. Coverage details and timelines vary widely by state, so check your state's unique programme to see if you are eligible.

Local Government Entities

Another fantastic area to look for help is within your own neighbourhood. Many funding programmes have been established at the state, county, and municipal levels to address medical emergencies. Even if they do not cover the entire cost of treatment, they can help to postpone the time it takes for your bill to be sent to collectors. This may give you enough time to obtain the remaining monies on your own and avoid collectors entirely.

Charities

Where the government falls short, private charities step in to fill the void. If you have a certain disease, there may already be a foundation in place to assist you. Charitable contributions can be used to pay for treatment-related expenditures, such as chemotherapy, or for medical items, such as wheelchairs and hearing aids. For detailed lists, use directories such as the Patient Advocate Foundation.

Charity Concerns

Your hospital may be able to help you at times. This section, often known as charity care, actively seeks to connect you with sources of assistance. Remember that hospitals are more concerned with whether or not you are making payments than with where you are getting your money.

The efficiency of these programmes will be determined by the organisation with which they are linked. Some will have abundant resources, while others will be nothing more than skin and bones. A competent application will be able to collaborate with billing agencies and recalculate the amounts owed on existing bills.

5. Work out a Payment Plan

Providers of health care want to be compensated. They don't want to send invoices to collections or compel patients to declare bankruptcy. They will be considerably more likely to offer you a reasonable payment plan if you demonstrate your commitment to pay.

These programmes have no interest charges and are priced to be affordable based on your current income level. It's critical to be honest about how much you can afford to pay each month. Your current income is important, but so is your total financial burden. The more evidence you have to back up your ability to pay, the better.

If you consistently fail to make agreed-upon payments, the billing department may lose patience and send you to collections. This would complicate your life even more and potentially lead to lawsuits in the future. It's best to prevent this entirely by negotiating a fair price.

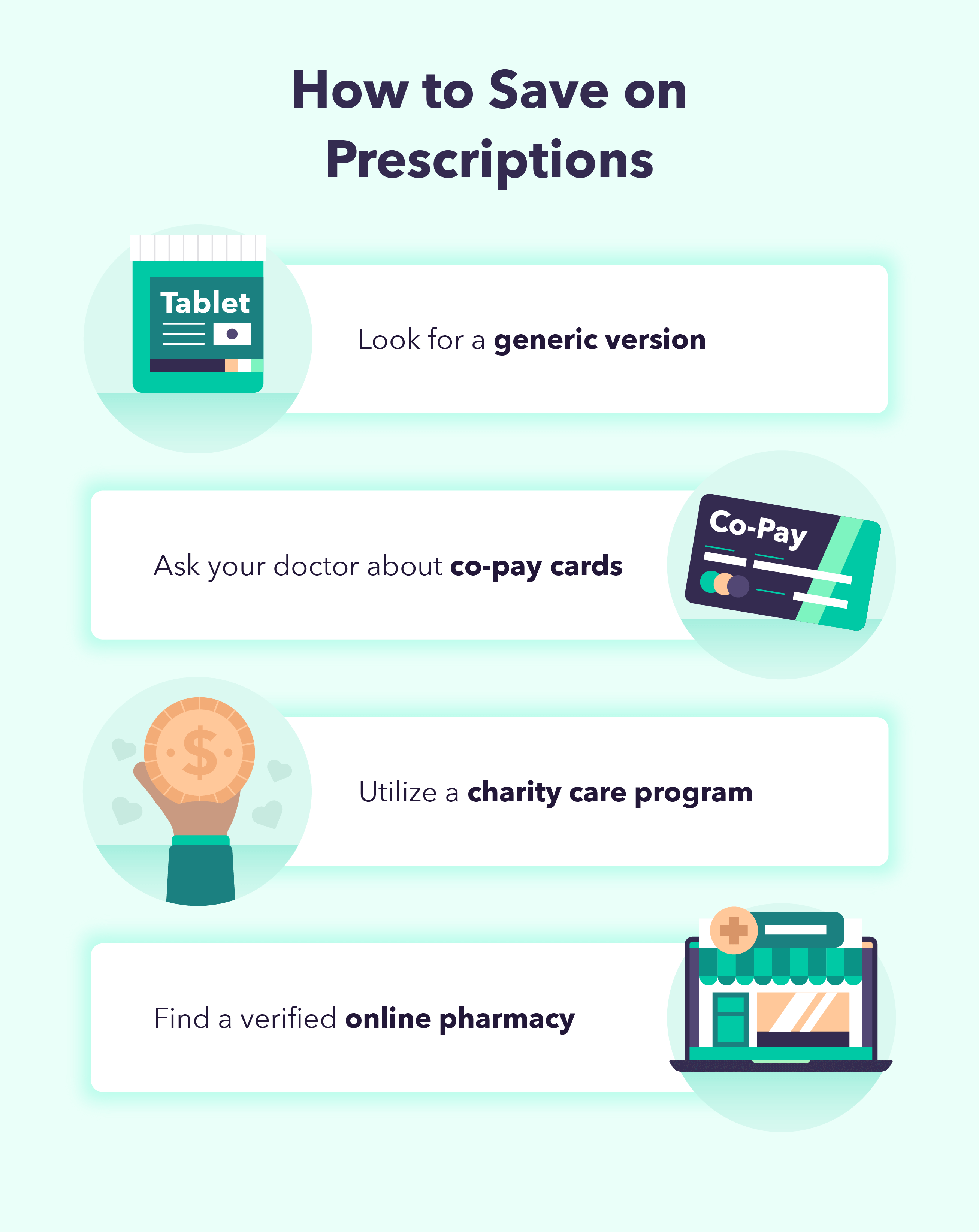

6. Find Discounts on Prescriptions

The expense of filling periodic medicine prescriptions can quickly exceed the cost of treatment itself. There are numerous options for obtaining discounts on this vital medication. The most popular approach is to seek out a generic counterpart of the name-brand option. However, not all prescription pharmaceuticals are available in generic form, and not all patients are willing to face the risk of switching from the name brand. There are charity choices in certain circumstances as well.

Many pharmaceutical companies have charity care programmes in place for persons who cannot afford the cost of their prescriptions. Visit the manufacturer's website to learn more about the qualifications and get linked to helping programmes, or contact the company directly to get access to their application.

Look for co-pay cards to help you lower your out-of-pocket spending. Many people save up to 80% on their bills, while others pay nothing. Your doctor or pharmacist should be able to recommend reputable suppliers for your requirements.

Finally, you may get prescription drugs from overseas pharmacies online. As long as the supplier is verified, this is a safe and legal way to get your prescription at a lower cost.

7. Do Not Disregard Your Bill

Most people are aware of the worry that arises when confronted with a large bill. It may be tempting to put it back in the envelope and forget about it, but you must resist this temptation. The amount you owe will not vanish unless you do something about it.

If you don't pay on time, your credit score will suffer, and you'll have to deal with debt collectors who are far less understanding than your hospital's billing department. Being proactive about your circumstance will be the single most important move you can do to improve it.

What Is the Best Way to Pay Medical Bills?

When it comes to how they get money for their services, medical professionals can be fairly flexible. However, just because you have the option to pay in any given mode does not always mean it is at your best advantage to do so. Some of the advantages and disadvantages are discussed further below.

Cash

Most business owners prefer cash as a form of payment, and the medical industry is no exception. Any person, regardless of insurance coverage, will be able to significantly lessen their overall bill by promising to pay your duty immediately and in cash.

Keep your monthly budget in mind at all times. You may have enough cash on hand to pay your bill right away, but if doing so jeopardises your capacity to make additional payments in the near future, you should avoid it. It may be advisable to engage in a payment plan, even if it means paying a little higher total sum.

Card Payment

Due to the fees connected with charging credit cards, patients are unlikely to be granted the same types of discounts as with cash. Credit cards also carry the additional danger of hefty interest rates for late payments. In most circumstances, patients would be better off avoiding this choice and instead of negotiating a zero-interest payment plan with their health care provider.

This may be a worthwhile alternative if you are responsible enough to make your payments on time and enjoy the convenience of using your credit card. You may also be able to earn reward points.

Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

Health savings accounts and flexible spending accounts were created specifically to pay for medical expenses. They are tax-advantaged funds that function similarly to a bank account in that you can set money aside in the event that you have medical expenditures to pay.

A health savings account is typically provided by your insurance carrier and has no deadline, whereas a flexible spending account is typically provided by your company and must be spent by the end of the year.

Not everyone has access to one of these accounts. Those who do have access must ensure that the account is funded before using it.

Plan of Payment

Those who do not have the finances to pay their debt may benefit from pursuing a payment plan. This can be sorted up directly with the billing department of your health care provider.

You'll need to explain to them how much you can consistently afford to pay each month. Consider your present income and additional expenses. If you overestimate your ability to pay and end up skipping payments, they may be less accommodating to your requirements in the future.

Unlike dealing with creditors, no interest will be added to your payment, and your credit score will be untouched. After that, all you have to do is follow through on your commitment.

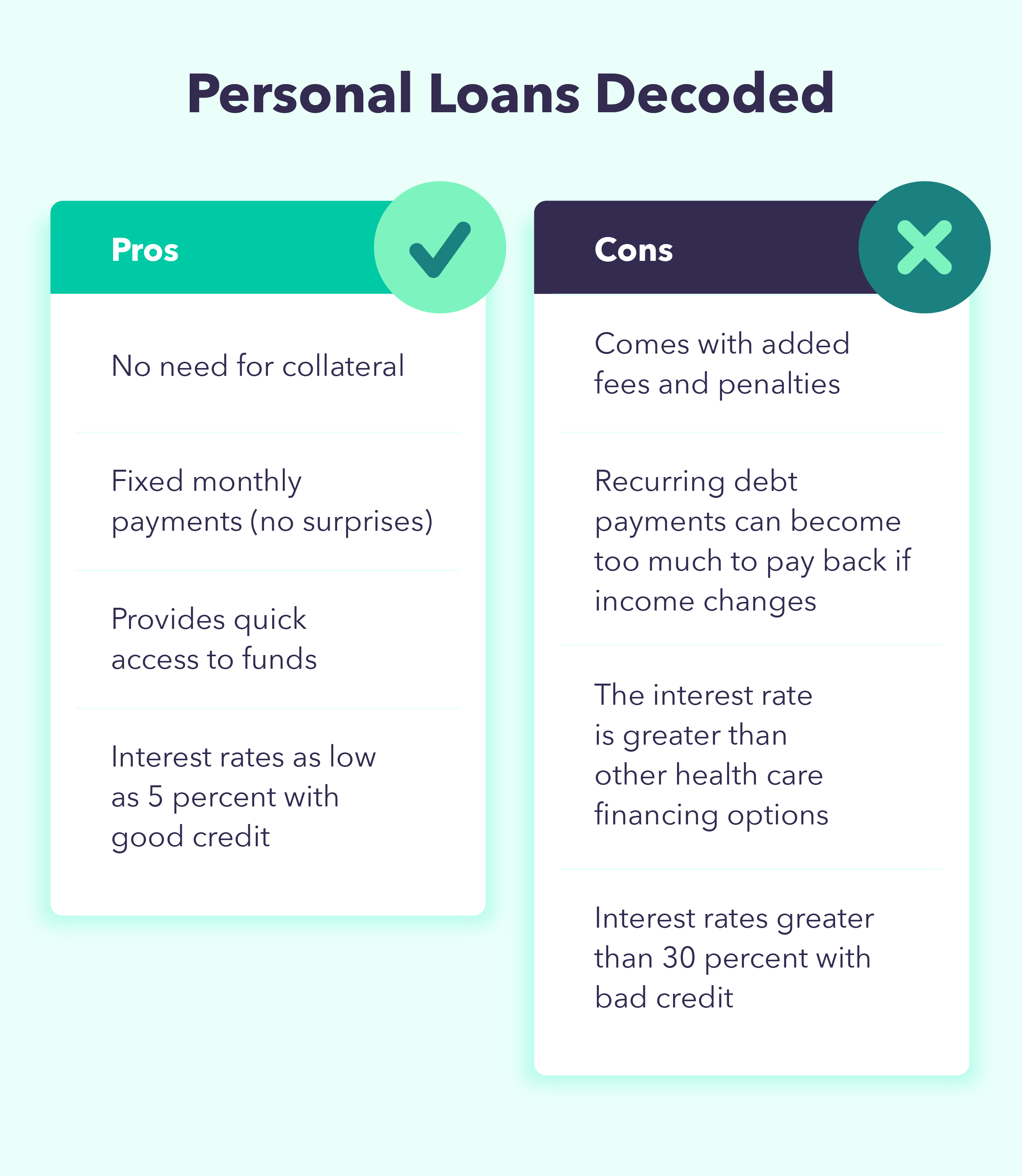

Personal Loans

When you're in a bind, a personal loan might be an excellent source of much-needed income. As with using a credit card, it's critical to grasp all of the implications.

The interest rate on your loan can vary substantially based on your credit score. Those with credit scores less than 600 may find their interest rates unmanageable. Those with credit scores above 700 may be able to take advantage of a lower rate even if they do not have collateral.

This is unlikely to be anyone's first choice when it comes to paying their expenses. Only after all other options have been exhausted can a personal loan be considered. It can still be considered a feasible alternative if it can save your debt from going to collections.

Bankruptcy

Filing for bankruptcy is the final resort for people who are drowning in medical debt. However, keep in mind that the consequences of bankruptcy can linger for many years and influence more than simply your medical debts.

One of the benefits of declaring bankruptcy is that it immediately halts your creditors' pursuit of you until your case is concluded. This might provide instant relief to folks who are owed money by many creditors.

When you file for bankruptcy, however, there are no certainties regarding your assets. Your objective may be to liquidate your debts, but you may also be liquidating your assets in the process.

Some persons who have medical debts file for bankruptcy in order to start again. They can be in a better financial position than when they started if they execute strategically.

Bottom Line: Do Not Be Afraid to Seek Help.

Many people find discussing their finances to be scary. If you're having trouble figuring out how to negotiate medical expenses, you should try consulting with a financial professional. Using a financial tool such as Mint can assist to simplify the complex world of money management. Many people have been in your exact situation and found a way out. You, too, can.

Sources: Census | Medliminal | Healthcare Insider | Patient Advocate Foundation| Debt.org

The post How to Negotiate Medical Bills: A Simplified Guide + What You Need to Know appeared first on MintLife Blog.

The post How to Negotiate Medical Bills: A Simplified Guide + What You Need to Know appeared first on https://gqcentral.co.uk